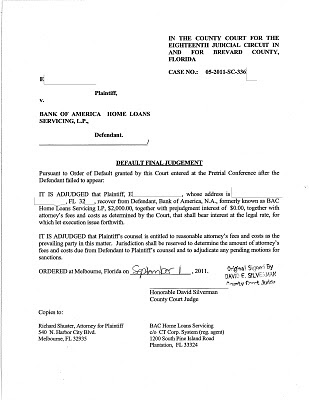

A previous blog post described how Shuster & Saben, LLC sued Bank of America for violations of the Florida Consumer Collection Practices Act, ( FCCPA) on behalf of a Brevard County foreclosure defense client. The firm filed a separate lawsuit against Bank of America rather than filing a counterclaim in the underlying foreclosure case. After Bank of America failed to show up for Court the firm obtained a default and a default final judgment for $2,000.00 of damages for our client. When Bank of America failed to show up for the fee hearing the firm obtained an award of attorney’s fees, costs, expert witness fees and interest of over $6,700.00. When Bank of America failed to pay the judgments within ten days, firm attorney Richard Shuster, wrote Bank of America’s in-house legal department and threatened to levy on the judgment and seize bank assets in Melbourne, Florida if the judgment was not paid by November 23, 2011. Earlier this week, as the firm prepared to levy on the judgment, a check arrived by Federal Express at the firm’s Melbourne office. Our client will now receive $2,000.00 in damages plus interest for Bank of America contacting the client after a notice of attorney representation was sent to the bank. All of the attorney’s fees and costs for the litigation have been paid by Bank of America. While Bank of America’s foreclosure action against our client continues, our client’s case against Bank of America was won in under six months.

About Shuster & Saben: Shuster & Saben accepts referrals from other law firms whose clients have been directly contacts by lenders and loan servicers after such companies were put on notice that the consumer is represented by counsel. We also co-counsel with firms that have not previously sued banks and loan servicers. Shuster & Saben has a zero tolerance policy for lenders, loan servicers, and bill collectors who harass firm clients with letters or calls. Consumers with questions about the FCCPA or who want calls from bill collectors to stop can contact the firm by E-mail at foreclosuredefenselaw@gmail.com.