Monday, September 26, 2011

Shuster & Saben Defaults Bank of America

Banks win most of their cases by default, the legal equivalent of a forfeit in sports. For a bank to win a case by default the homeowner must bury their head in the sand and fail to respond to the lawsuit filed by the bank. When Shuster & Saben, LLC sued Bank of America subsidiary BAC Home Loan Servicing, the shoe was on the other foot, when Bank of America failed to show up for a mandatory pretrial hearing. At the hearing the Court entered a default against Bank of America. A few days later after submission of an affidavit as to damages the Court entered a default final judgment against the bank. The law suit filed on behalf of a foreclosure defense client sought damages for violation of RESPA ( Real Estate Settlement Procedures Act ) and FCCPA (Florida Consumer Collection Practices Act ). Bank of America as the losing party in the litigation will also have to pay all of the homeowner’s legal fees, in addition to the amount of the judgment for damages. Since the bank will have to pay our client’s attorney’s fees the entire judgment amount will go to the client.

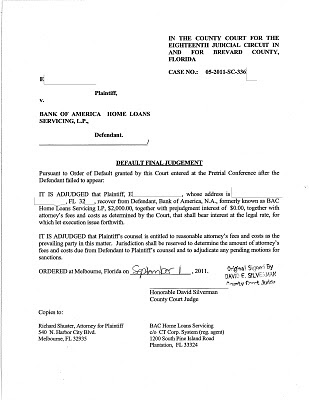

To review a redacted copy of the default final judgment please click the link below:

Redacted Default Final Judgment

UPDATE: NEW POST - We Collected on the Judgment

About Shuster & Saben: Shuster & Saben believes the ultimate result of many foreclosure cases can be improved by going on offense and bringing a separate lawsuit for any bank violations of consumer protection laws. Shuster & Saben accepts referrals from other law firms whose foreclosure clients’ rights have been violated where the referring firm does not wish to handle the file alone or would prefer to refer the case to a firm with greater experience suing banks and loan servicers.

Subscribe to:

Post Comments (Atom)

Appreciate you guys putting this up for us lay people to see...it's intimidating being against these big banks but knowledge is key..thanks again...

ReplyDeleteWill keep you as referrals when a client needs it..hopefully i'm not too far..

-Joe Salcedo